The UK economic outlook and what it means for the UK Tech sector

Uncover the latest insights into the current status of the UK economy and the impact it is having on the UK tech sector during 2023.

Written by Julius Probst, PhD, European Labour Economist at StepStone

Sluggish growth instead of recession

The UK economy is not in a great spot. Inflation is still exceeding 10% and wage growth is also too high for the Bank of England’s (BoE) liking, which is why interest rates will continue to go up.

However, at the beginning of the year, consumer confidence and business sentiment improved substantially, and many forecasters are now expecting sluggish growth this year instead of a recession. The OBR and the National Institute for Economic and Social Research (NIESR) are projecting that the UK economy will avoid a downturn after all in 2023. However, forecasts about the economic outlook also vary quite widely, showing how the current macro environment is dominated by a lot of uncertainty.

The two biggest downside risks right now are financial market instability as well as the housing market. The recent bank failures in the US and Switzerland have made it clear that financial institutions are vulnerable to the aggressive rate hike cycle that Central Banks in advanced economies have implemented to bring down inflation.

Similarly, there has been a significant slowdown in the housing market. With surging mortgage rates, real estate transactions have slowed down and higher interest rates than expected could lead to a significant house price correction that could potentially plunge the economy into recession.

For now, none of this is happening and the economy is holding up much better than expected.

A white-collar slowdown?

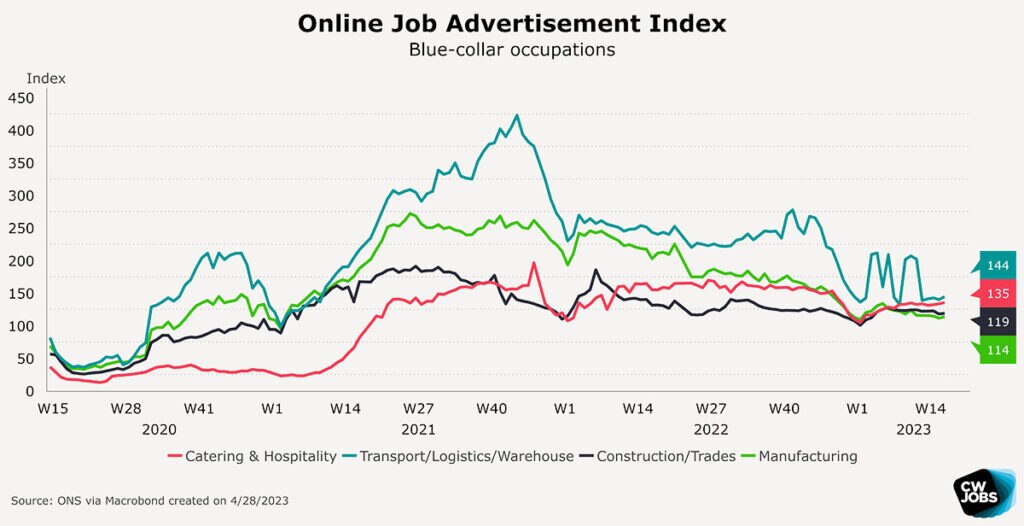

2022 saw a record-tight labour market that is currently slowing down as the BoE is hiking rates aggressively. A few months ago, I wrote about the current divergence between white and blue-collar jobs in the UK. Tech sector jobs, in particular, were booming last year and are now seeing a substantial slowdown in hiring. Sectors with more manual jobs, on the other hand, continue to see labour shortages since Brexit. This is especially the case for workers in the leisure and hospitality sectors.

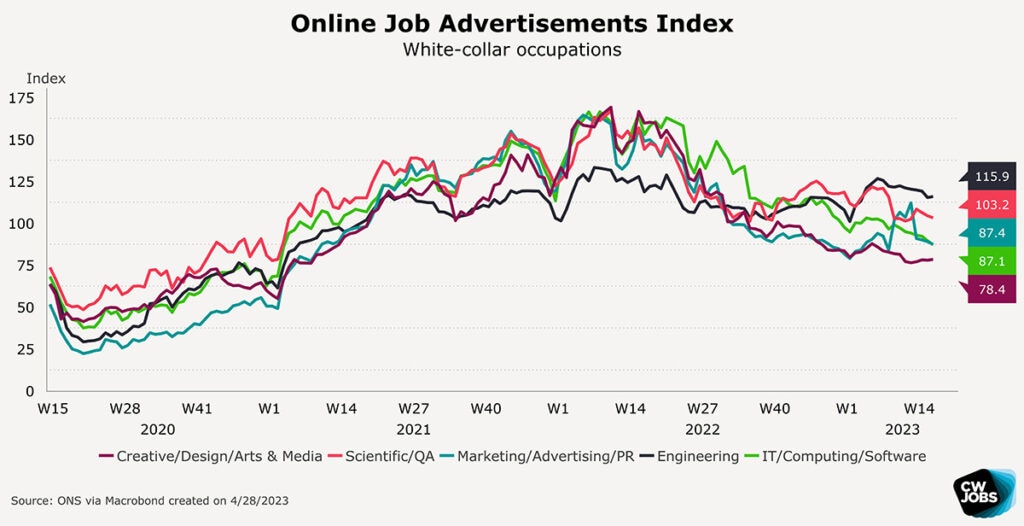

The following chart shows how job postings for white-collar occupations have slowed down significantly in recent months. This is especially true for the IT sector which saw a record number of vacancies last year but is currently experiencing some weakness with vacancies slowing down to pre-pandemic levels.

White-collar occupations, on the other hand, have not seen a similar decline just yet and vacancies are remaining elevated for now.

Tech saw the strongest employment growth and highest wage gains during the pandemic

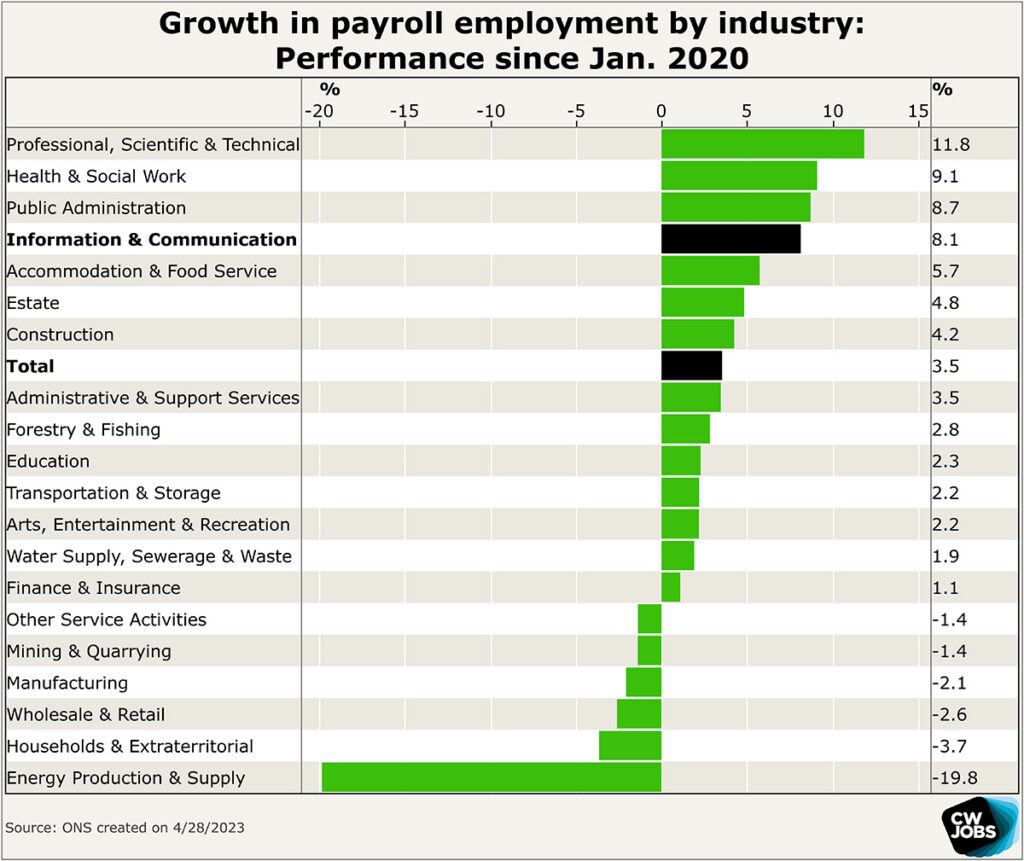

The following chart shows payroll growth by industry. Professional workers and scientific staff have gained the most with payroll employment up by more than 10% since January 2020. Information and communication come in third place and payroll employment growth has been close to 9% since the beginning of the pandemic.

It is thus one of the strongest performing sectors in the UK even as the slowdown in vacancies is now suggesting some weakness ahead. Some of this is related to the Tech wobble in the US. While the sector has not shed that many jobs in the aggregate, it is particularly the large US tech companies like Amazon, Google, Meta, and Twitter, which have been laying off workers in recent months.

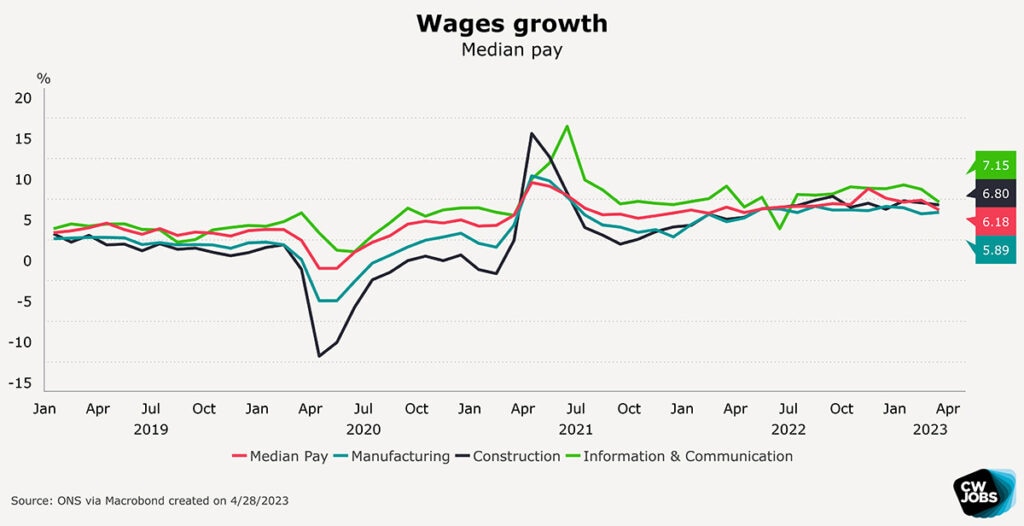

Thanks to its strong sectoral performance, tech sector employees have also seen above average wage gains since the beginning of the pandemic with median pay comfortably rising by more than 10% throughout 2021.

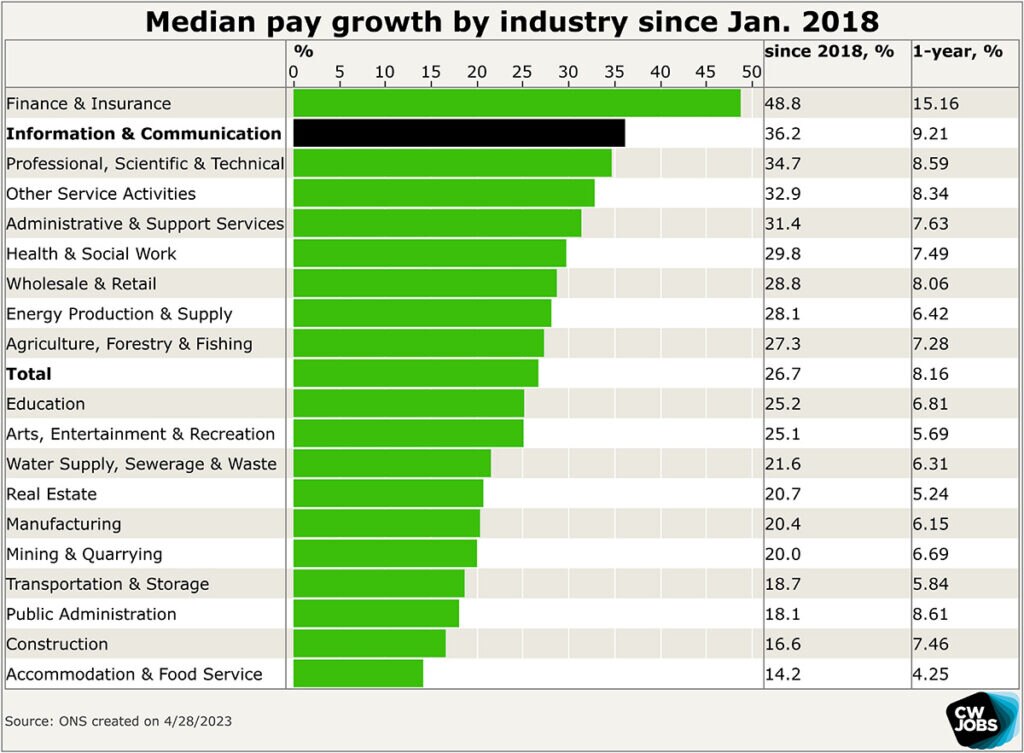

Median pay in the tech sector is up by more than 36% since January 2018 and about 25% since January 2020 compared to 26% and 17%, respectively, for the economy as a whole. For most other sectors, the median pay growth has increased by about 10 to 20% since January 2020.

Tech workers have thus outperformed their peers by a quite sizeable margin since the beginning of the pandemic. And tech is one of the few sectors where pay has outperformed inflation in recent years (prices are up by about 19% since the beginning of the pandemic).

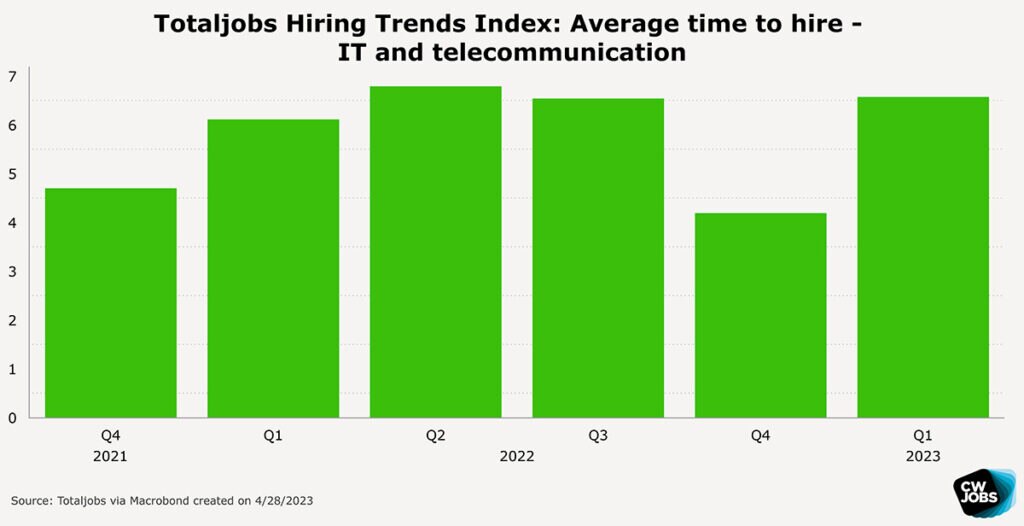

The Totaljobs Hiring Trends Index shows that the time to hire in the tech sector is still quite elevated compared to 2021. It takes about 6.5 weeks to fill a position in the IT and telecommunication sector, unchanged from last year. It thus looks like the tech sector is still relatively tight even as one reads about layoffs at some of the large US tech companies like Amazon, Google, and Meta.

Mirroring the situation in the US, those layoffs at the tech giants have not translated into declines in employment in the sector at large as of right now.

The UK has a more dynamic tech sector than continental Europe

While the short-run outlook for the tech sector is currently overshadowed by sluggish growth, the good news is that the UK economy might not fall into recession after all. And with the record tight labour market of 2022, many companies will aim to retain workers instead of going for layoffs right away because hiring more employees once the economy picks up has been more of a challenge.

In the long-run, the UK is well-placed as a leader in Europe with a more dynamic tech sector than Germany or France. Access to capital and funding is better thanks to London’s position as Europe’s largest financial centre.

During 2022, tech companies in the UK have raised some 24 billion pounds, which is higher than the capital in Germany and France combined (about 10 billion pounds each), according to a report from the UK government. This has allowed the UK to produce almost 400 high-growth startups since 2000, worth more than $250 million in value. In terms of total valuation, the tech industry reached the milestone of 1 trillion pounds, meaning that it is well ahead of its European peers. Monzo, TransferWise, and Revolut are just some of the UK tech startups that have reached a valuation of more than a billion pounds in recent years. Many of those startups are in the fintech space and are located in the capital.

But it is not like the UK technology sector is exclusively London-based. Cities like Cambridge, Edinburgh, Manchester, Nottingham, and Oxford all have their own tech ecosystem. Collectively, these cities have more tech unicorns than Germany and France combined right now.

The fact that the tech sector is not just London-centric is an advantage for future economic growth. The current cost-of-living crisis is probably more acute in the capital than elsewhere, especially when it comes to housing affordability. It might become more and more attractive for workers and employers alike to be located in the UK’s tier-2 cities.

Conclusion

The UK economy is currently experiencing a strong slowdown but will in all likelihood avoid a recession. After record strong growth throughout 2021 and early 2022, vacancies in the tech sector have fallen significantly. However, this is just some cyclical weakness. In the long-run, the UK tech sector is better positioned than its European counterparts for several reasons: Access to capital funding with London’s role as a global financial centre, good integration with world-class universities like Cambridge and Oxford, and as an English-speaking country being able to attract talent from all over the world.